UTILIZE TAX LOSSES

Tax losses generally fall into two categories: non-capital losses and capital losses. Non-capital losses arise from normal business operations (i.e. where deductible dental practice expenses exceed dental revenues). Capital losses arise when you sell assets such as investments for less than what they cost you (i.e. you purchased a stock for $100 and sold it for $50).

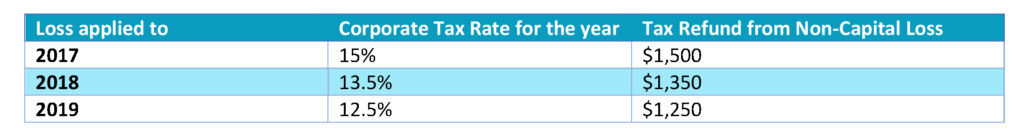

With office closures occurring during COVID-19, you likely experienced several months where expenses exceeded your income. Many expenses such as interest, rent, insurance, utilities and salaries may not have been deferrable or forgiven during this time leading to expenses but not income. It is possible that at the end of your business’ year-end, you may have a non-capital loss. Non-capital losses can be carried back 3 years or carried forward for up to 20 years to be applied against those years which show a profit thereby generating a tax refund. Generally, it is better for non-capital losses to be first carried back up to 3 years assuming the business was profitable in that year. Why? Corporate tax rates have been decreasing during the past few years. Depending on the year you apply the tax loss to, a $10,000 non-capital loss could result in the following:

A 2.5% difference might not seem like much, but if you have large losses (tens of thousands of dollars), it does add up. If you believe that corporate tax rates might be going up in the future, you could instead choose to save those losses to apply to a year when corporate tax rates are higher. Alternatively, if you are going to exceed $500,000 in dental profits in the coming years, you might want to save those losses as corporate profits over $500,000 are taxed at 26.5%. However, by not carrying the non-capital loss to a previous year, you are also deferring the resulting tax savings. Carrying back results in an immediate tax refund, whereas applying the loss to a future year will not benefit you until that future year.

Utilizing capital losses is a game of timing. It’s important to note that all investments gains/losses are either unrealized or realized. Unrealized gains and losses means the investments have not been sold or deemed to have been sold and therefore no gain or loss needs to be reported. For example, you purchase shares at $50 and they are worth $500 but are holding on to them. In this case, you have an unrealized gain of $450 and are not required to report the gains for tax purposes. A realized gain or loss is where the investments have been sold or deemed to have been sold. For example, you purchase shares at $50 and you sell them for $500, you use that $500 to buy more investments. In this case, even though you still have $500 in investments, you have a realized gain of $450 because the shares were sold.

For investments that you don’t think will recover in value, review whether you have unrealized capital losses. Before the end of your tax year, you may wish to sell them and realize the loss so that those they can be used against any realized capital gains. Capital losses can also be carried back up to 3 years and carried forward indefinitely. There is a special tax rule for capital losses. Be sure to wait at least 30 days before you buy back the same investments you sold, otherwise the tax losses will be disallowed.

LOSS CONSOLIDATION

Where you have more than one corporation/business, you may be able to redistribute and allocate some expenses between the companies. For example, where one has a Profession Corporation (PC) and Hygiene and Technical Service Corporation (H/TSC) and both are sharing expenses such as rent, salaries and supplies, you may be able to redistribute expenses to convert losses in one company into income for tax purposes. It’s better for both companies to show a smaller profit than for one company to show a loss and the other a large profit. However, ensure you review/discuss such redistributions with your accountant to ensure they make sense.

You may also wish to evaluate whether you need more than one corporation. With the changes in income splitting rules in the past couple years, perhaps it is time to re-evaluate the benefits and costs of having more than one corporation.

MULTIPLYING THE LIFETIME CAPITAL GAINS EXEMPTION (LCGE)

Adding family members as equity shareholders means increasing the number of LCGE available when you ultimately sell your practice. Generally, the earlier you do so the better as this allows time for the value of your family member’s shares to grow. COVID-19 presents an opportunity to add family members because the cashflow of the practice has likely decreased in the last few months which means the value of the practice has also likely decreased. This allows your family members to receive shares in your corporation at a depressed value.

Consider the example below:

A dentist and his/her spouse are 50/50 shareholders of their PC. They wish to add their child as an equity shareholder.

If the child was added prior to COVID-19, the value of the child’s shares would be up to $200,000 ($2,400,000 minus $2,200,000). Due to COVID-19 and the temporarily depressed value of the practice shares, the child’s shares could have a value of up to $750,000. This allows the family to maximize the use of their LCGE and transfer $550,000 of value to the child. This $550,000 would have been taxed in the parent’s hands on the sale but is now sheltered by the child’s LCGE.

If the child was added prior to COVID-19, the value of the child’s shares would be up to $200,000 ($2,400,000 minus $2,200,000). Due to COVID-19 and the temporarily depressed value of the practice shares, the child’s shares could have a value of up to $750,000. This allows the family to maximize the use of their LCGE and transfer $550,000 of value to the child. This $550,000 would have been taxed in the parent’s hands on the sale but is now sheltered by the child’s LCGE.

LOCKING IN THE LCGE

During COVID-19, the government announced an unprecedented amount of benefits and payouts to Canadians. While those handouts might feel great now, at some point, someone will have to pay the bill. That means tax changes may be coming. Some possibilities include:

- ▪ Increase in corporate tax rates

- ▪ Increase in personal tax rates

- ▪ Increase in sales tax rates

- ▪ Increase in capital gain tax rates

- ▪ Elimination of tax credits/deductions/exemptions such as the LCGE

The government may choose to implement none, some or all of the above. You still have control over the LCGE for you and your family. Claiming the LCGE now while it is still available means you lock it in so that the government cannot take it away from you later.

About the Authors

This article was prepared by David Chong Yen*, CPA, CA, CFP, Louise Wong*, CPA, CA, TEP, Basil Nicastri*, CPA, CA and Eugene Chu, CPA, CA of DCY Professional Corporation Chartered Professional Accountants who are tax specialists* and have been advising dentists for decades. Additional information can be obtained by phone (416) 510-8888, fax (416) 510-2699, or e-mail david@dcy.ca / louise@dcy.ca / eugene@dcy.ca . Visit our website at www.dcy.ca. This article is intended to present tax saving and planning ideas, and is not intended to replace professional advice.