Two, Four, Six, Eight! Maximize and Appreciate!

This article is the second in a three-part series that reviews some of the major considerations in preparing for practice ownership transition and comprehensive retirement planning. In the previous article, we discussed the two most common ways in which a dental practice is sold and four ways to maximize your practice’s value. This article will share six crucial themes that create a framework to maximize your wealth and minimize your risk.

SIX… There are SIX critical themes to consider if you want to be ready:

Vision and values are the cornerstones of a robust financial plan. When dentists determine what underpins their long-term goals, implementing a plan and correcting course in the face of a challenge becomes less cumbersome. Optimizing investment portfolios is an integral part of the journey toward achieving your financial goals. Whether you’re a young dentist starting out or transitioning out of ownership, reviewing your investment portfolio’s suitability and performance is essential. Along the same lines, reviewing your insurance portfolio according to your needs, circumstances or risk profile provides peace of mind for a range of potential outcomes. Your insurance needs adapt as you move through different career stages, so it’s essential to ensure that you have the coverage that suits your unique context. And, finally, efficient tax structuring can contribute toward achieving financial goals by considering your family’s specific circumstances. Whether your financial portfolio includes corporations, trusts, or employed individuals, ensuring that taxation is correctly and efficiently structured can contribute toward achieving financial goals.

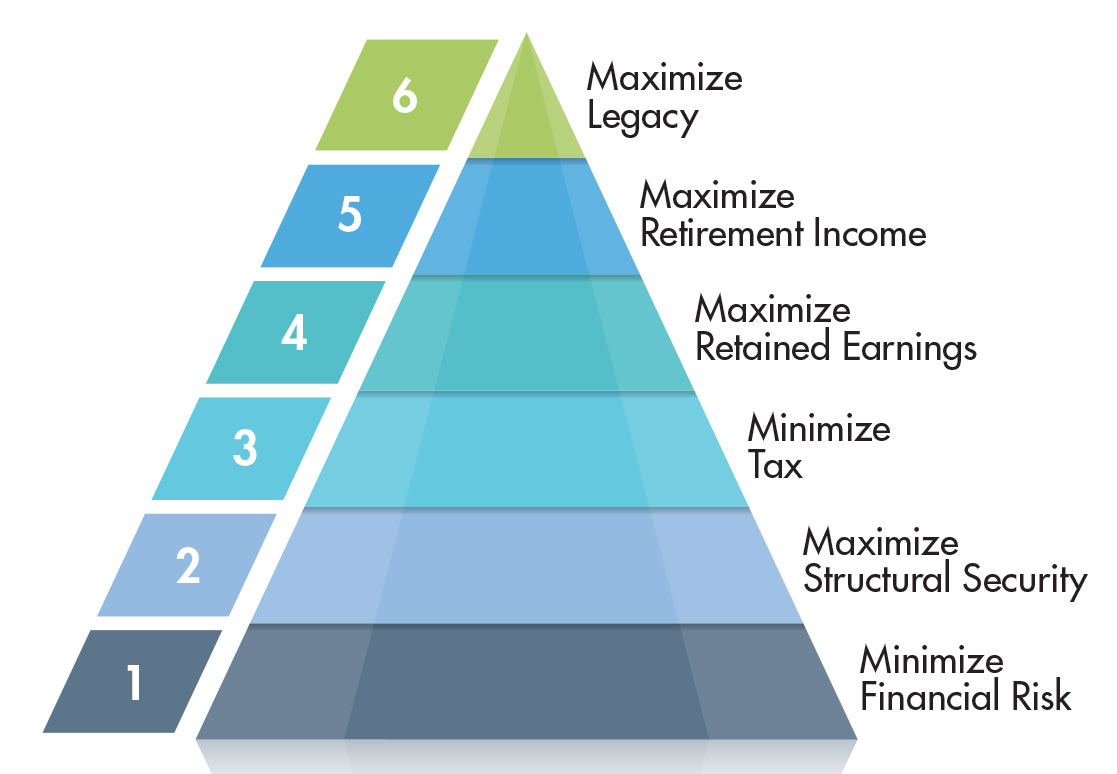

Farber Wealth has developed a helpful needs-based framework that illustrates six “Critical Themes” that create a framework to maximize wealth and minimize risk.

- MINimize Financial Risk

- MAXimize Structural Security

- MINimize Tax

- MAXimize Retained Earnings

- MAXimize Retirement Income

- MAXimize Legacy

Figure 1: Farber Wealth’s Six Critical Themes to help structure your financial goals

Themes 1 and 2 form the foundation of your financial future. The foundation of any professional’s financial plan should be the protection of your greatest asset – your health. Consider what the unintended consequences could be for your family or the impact on your practice if you overlook this vital area. What would the financial impact and resulting stress be if one of your family members contracted a major disease? Have you made provision for protecting your household’s monthly income in case of short-term or long-term disability? Have you considered providing for the overhead costs of operating the practice if you aren’t there for a time because of an injury or illness? In the case of death, what measures need to be in place to meet your family’s financial needs and maintain their lifestyle; not to mention paying off any debts of the practice? As for structures – although you may be limited by regulation – have you considered your options in order to make the most of your Professional Corporation? Do you have an up-to-date Will and POA documents? Do you have a second Will for the practice? Are you aware of the cost of failing to do these things?

Themes 3 and 4 become increasingly important as the practice grows. Minimizing tax becomes a life-long battle that requires diligence and planning, not only year-over-year but also with a longer-term viewpoint. It is brutal what the various levels of tax extract from our pockets over a lifetime. Taking some time with your advisors to map out how to minimize it on an ongoing basis is critically important. As the simple analogy goes: it’s rather pointless pouring even more water in to fill a bucket that is riddled with holes. Better to figure out how to fix the holes! MAXimizing Retained Earnings refers to, among other things, learning to pay yourself first from profits – taking some of it “offline” and investing it for your future. In addition to this, it is learning how to invest in assets through your corporation that do not attract tax – either while growing or when being extracted. The government has taken many tax-reducing opportunities away so it’s important to understand the most powerful strategies that remain.

Theme 5 is planning for retirement. As mentioned earlier, timing and motivation for a practice owner to step away from practice ownership or retire completely from dentistry differ for each individual dentist. Some may choose to scale down completely, go part-time or continue to work full-time. By planning for this decision early on, families can have the financial freedom to make the right decision at the right time. A key consideration here is what value you need in your investment to support the retirement option that fits best for your family, and what’s your number that you believe you need from the sale of your practice in order to retire on your terms.

The sixth Critical Theme is to MAXimize your legacy. Ultimately, it’s about how your family’s wealth may be impacted and what protective measures need to be in place. Much consideration is given here to the impact of income tax, whether on the various forms of investment (corporate or personal), and, ultimately, in your estate, where often the largest single “donation” to the CRA is made. Your advisors must be well-versed in all things “tax” and understand what you can do to reduce or even eliminate the impact of tax upon your ultimate passing. You can know that you’re leaving a meaningful legacy – whether to family, charity or both – and writing Ottawa right out of your Will. Now that’s worth considering!

Throughout the six critical themes, dentists and their families are encouraged to think clearly about both the intended and unintended consequences that may occur if they don’t have a robust financial plan in place. The objective is always to use your family’s goals as a starting point and to empower you with the knowledge and tools to track and achieve those goals.

Having reviewed the two ways a dental practice is sold, the four ways to maximize practice value, and now the six critical themes to consider maximizing wealth and minimize risk, the next and final article in this three part series will review eight keys to a smooth transition.

About the Authors

Philip Evenden is a Director with the Wealth Management practice at Farber. His focus is on advanced financial planning for the successful – active or retired –entrepreneur. pevenden@farbergroup.com

Philip Evenden is a Director with the Wealth Management practice at Farber. His focus is on advanced financial planning for the successful – active or retired –entrepreneur. pevenden@farbergroup.com

Dr. Sean Robertson is a licensed dentist and founding partner of The Dental Broker Team, a full-service appraisal, sale and transitions firm for dentists. Reach him at sean@dentalbrokerteam.com.

Dr. Sean Robertson is a licensed dentist and founding partner of The Dental Broker Team, a full-service appraisal, sale and transitions firm for dentists. Reach him at sean@dentalbrokerteam.com.